Find Your Best Refinance Options & Rates... Fast & Free!

Get an Accurate Rate Quote Today!

Find Your Best Mortgage Options & Rates... Fast & Free!

Get Pre-Approved Today and Shop with Confidence!

Refinance Loans

Refinancing can be a strategic financial move with Michigan Mortgage Solutions. Our refinance loans help you save money or access home equity, allowing you to achieve financial goals with ease. This involves replacing your existing mortgage with a new one, typically at a lower interest rate or with different terms. This can lead to reduced monthly payments, shorter loan terms, or access to your home’s equity for other needs.

Why Choose Michigan Mortgage Solutions For A Refinance Loan?

Our unique educational approach sets us apart by prioritizing transparency and empowerment for every borrower. We believe that an informed client is a confident client, which is why we break down complex mortgage concepts into easy-to-understand steps. This ensures that you not only feel comfortable with your refinance choices but also make decisions that align with your financial goals.

We guide you step by step through the refinance process, from the initial consultation to the final approval, ensuring that no question goes unanswered. Our team is dedicated to making sure you fully understand each phase, from rate quote to closing, while also identifying strategies to reduce your out-of-pocket expenses. By addressing potential challenges early and tailoring solutions to your unique situation, we help streamline what can otherwise be an overwhelming process.

Our ultimate goal is to match you with the best refinance program that fits your financial needs and future plans while making the experience as smooth as possible. We handle the details so you can focus on your homeownership journey with confidence and peace of mind. Our approach is designed to take the stress out of refinancing and replace it with clarity and support.

How Can Our Refinance Loans Benefit You?

At Michigan Mortgage Solutions, we focus on providing personalized mortgage lending services. Our experienced team works closely with you to understand your financial situation and goals, helping you secure a refinance loan that best fits your needs.

Our competitive rates and expert advice ensure you get the best deal possible. At the end of the day, our goal is to earn your mortgage business for life as most borrowers have a need for a mortgage more than just one time. If we do our job right you will always think of Michigan Mortgage Solutions for your mortgage lending needs.

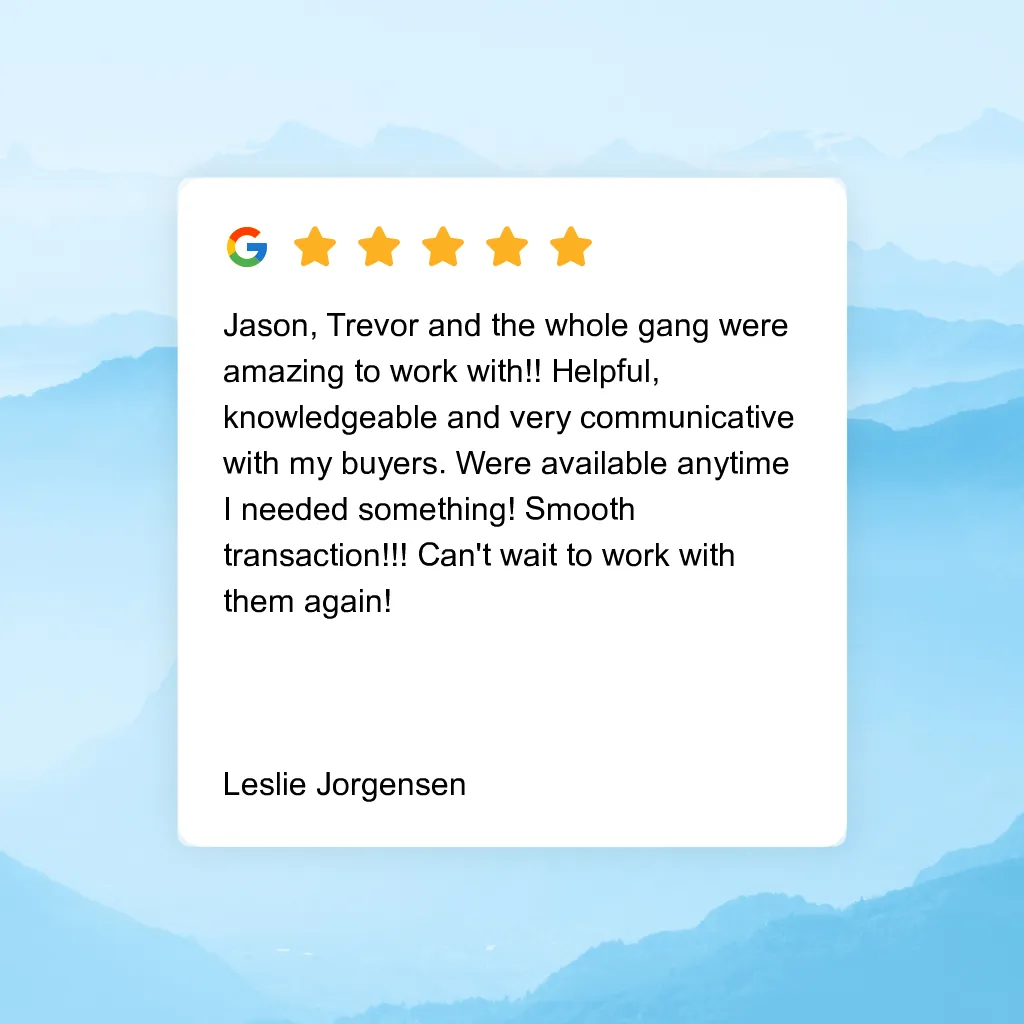

Recent Mortgage Reviews

Recent Mortgage Reviews

Our Process For

Refinance Loans

Step 1 - Complete Our Quick & Easy Home Loan Quiz

In just 45 seconds, you’ll provide the basic info needed to start your mortgage journey—no hard credit pull or long forms required. It's a fast, simple way to see your options and take the next step toward your homeownership or refinance goals.

Step 2 - Book Your Free Home Loan Consultation

Scheduling your consultation is quick and easy—just pick a date, select a time, and confirm your contact info. In minutes, you'll be all set to chat with a mortgage expert who will guide you through your options and answer all your questions.

Step 3 - Get Pre-Approved With An Accurate Rate Quote

Our pre-approval process is designed to give you clear, accurate details from start to finish. First, we run a soft credit check (so your score stays unaffected) and verify your income. Next, you provide a property address of interest, and we create a personalized financial breakdown using precise numbers based on your loan program and the property details.

Our Process For

Mortgage Lending

Step 1 - Complete Our Quick & Easy Home Loan Quiz

In just 45 seconds, you’ll provide the basic info needed to start your mortgage journey—no hard credit pull or long forms required. It's a fast, simple way to see your options and take the next step toward your homeownership or refinance goals.

Step 2 - Book Your Free Home Loan Consultation

Scheduling your consultation is quick and easy—just pick a date, select a time, and confirm your contact info. In minutes, you'll be all set to chat with a mortgage expert who will guide you through your options and answer all your questions.

Step 3 - Get Pre-Approved With An Accurate Rate Quote

Our pre-approval process is designed to give you clear, accurate details from start to finish. First, we run a soft credit check (so your score stays unaffected) and verify your income. Next, you provide a property address of interest, and we create a personalized financial breakdown using precise numbers based on your loan program and the property details.

Things to Know About

Mortgage Lending

Not All Mortgage Providers Are Created Equal

When it comes to mortgage lending, not all providers offer the same level of service or access to loan options. Banks and direct lenders may only provide their own limited set of mortgage programs, which can restrict your ability to find the best terms for your financial situation. They also mainly work bankers hours which may hinder your ability to speak with your lender after hours or on the weekend.

In contrast, working with a mortgage broker can significantly expand your options. Brokers have access to a wide network of lenders, which allows them to shop for competitive interest rates and loan programs tailored to your unique needs. This flexibility often results in better terms, lower fees, and a more personalized experience compared to traditional lending institutions.

Plus, at Michigan Mortgage Solutions we make ourselves available after hours and on weekends when our clients need us. The majority or purchase deals usually happen after hours or on the weekend so this is key to making the best offer.

The Importance of Avoiding a Hard Credit Pull Too Early in The Pre-Approval Process

A common misconception in mortgage loans is that a hard credit inquiry is required to get pre-approved, but this isn’t always true. Experienced mortgage professionals can use soft credit pull data to estimate your eligibility without impacting your credit score. This approach prevents unnecessary hard inquiries, which can lower your credit score and trigger unwanted outreach from competing lenders who purchase trigger leads.

By waiting to authorize a hard credit pull until you're ready to lock in a rate, you not only protect your credit but also maintain control over your mortgage process without unnecessary distractions or sales pitches from other lenders.

Why Online Reviews Matter When Choosing a Mortgage Lender

Before committing to a lender, it's essential to research online reviews to understand their areas of expertise. Many lenders focus heavily on refinance loans, and their customer service for home purchases—especially for first-time buyers—may not be as seamless.

If most reviews highlight positive experiences with refinancing but have limited mentions of purchase transactions, it could indicate a less-than-ideal fit for someone navigating the complexities of buying their first home. Look for reviews that mention successful purchases, responsiveness, and support throughout the home-buying process. This due diligence helps ensure you choose a lender experienced in your type of loan, leading to a smoother and more satisfying mortgage experience.

Work with Michigan Mortgage Solutions

At Michigan Mortgage Solutions, we’re dedicated to helping you navigate the mortgage process with ease and confidence. Our team combines years of expertise with a client-first approach to find the best mortgage program for your unique financial situation. Whether you're a first-time homebuyer or looking to refinance, our goal is to simplify the lending experience and secure the best terms for you.

We invite you to schedule a free home loan consultation to discuss your options and take the first step toward achieving your homeownership goals. Let us show you how personalized service and expert guidance can make all the difference in your mortgage journey.

Things to Know About

Refinance Loans

Things to Know About

Mortgage Lending

What Are Refinance Loans?

Refinance loans allow homeowners to replace their current mortgage with a new one, often with better terms. Whether you're looking for a lower interest rate, reduced monthly payments, or access to your home's equity, refinancing can provide significant financial benefits.

There are several types of refinance loans to consider:

Rate-and-Term Refinance: Focuses on securing a lower interest rate or changing the loan term.

Cash-Out Refinance: Lets you borrow against your home's equity, providing cash for other expenses.

Streamline Refinance: Offered for FHA, VA, and USDA loans, these programs provide a quicker, simpler refinancing process.

Understanding the type of refinance loan that suits your goals is the first step to unlocking its benefits.

How Refinancing Can Save you Money?

One of the primary reasons homeowners choose to refinance is to save money over the life of their loan. By securing a lower interest rate, you can significantly reduce your monthly payments and total interest paid.

Additionally, switching to a shorter loan term—such as a 15-year fixed mortgage—can save thousands of dollars, even if monthly payments are slightly higher. Refinancing also allows you to remove private mortgage insurance (PMI) if your home's equity has grown.

It's important to crunch the numbers with a mortgage professional to ensure refinancing will result in long-term savings.

When Is the Right Time to Refinance?

Timing is crucial when refinancing your mortgage. Consider refinancing if:

Interest rates have dropped significantly since you took out your original loan.

You have improved your credit score, qualifying you for better terms.

Your home has appreciated in value, giving you more equity to work with.

You're looking to consolidate debt or fund major expenses using a cash-out refinance.

Keep in mind that refinancing comes with closing costs, so ensure your potential savings outweigh these expenses.

Work with Michigan Mortgage Solutions

At Michigan Mortgage Solutions, we specialize in helping homeowners like you navigate the refinancing process with ease and confidence. Our team will evaluate your financial situation, discuss your goals, and guide you to the refinance loan that best meets your needs.

With access to a broad network of lenders and programs, we’re able to secure competitive rates and terms that work for you. Whether you're looking to lower your monthly payment, access cash, or pay off your mortgage faster, we’ll make the refinancing experience simple and stress-free.

Schedule a free consultation today and take the first step toward saving money and improving your financial future with a refinance loan tailored to your goals.

Contact Us

Service Hours

Social Media

Monday - Friday: 9:00 AM - 6:00 PM

Saturday: 9:00 AM - 12:00 PM

Sunday: Closed

More Locations We Serve

All Rights Reserved Corporate NMLS 136972

Contact Us

(248) 963-1894

35 W Huron St #301

Pontiac, MI 48342

Service Hours

Monday - Friday: 9:00 AM - 6:00 PM

Saturday: 9:00 AM - 12:00 PM

Sunday: Closed

Social Media