Find The Best Cash-Out Refinance Programs... Fast & Free!

Get a Refi Quote Today To See How Much Cash You Can Get!

Find The Best Cash-Out Refinance Programs... Fast & Free!

Get a Refi Quote Today To See How Much Cash You Can Get!

Cash-Out Refinance

Using a cash-out refinance is a significant financial step filled with opportunity and, at times, a bit of uncertainty. For homeowners in Michigan, the good news is that this option is designed to make accessing your home’s equity simple and affordable. Each borrower’s situation is unique, so it’s our job to pair you with the best cash-out refinance programs, providing you with essential information and actionable steps to help you achieve your financial goals, whether it’s consolidating debt, funding home improvements, or covering major expenses.

Why Choose Michigan Mortgage Solutions For a Cash-Out Refinance?

Our unique educational approach sets us apart by prioritizing transparency and empowerment for every borrower. We believe that an informed client is a confident client, which is why we break down complex mortgage concepts into easy-to-understand steps. This ensures that you not only feel comfortable with your mortgage choices but also make decisions that align with your financial goals when considering a cash out refinance.

We guide you step by step through the refinance process, from the initial consultation to the final approval, ensuring that no question goes unanswered. Our team is dedicated to making sure you fully understand each phase, from rate quote to closing, while also identifying strategies to reduce your out-of-pocket expenses. By addressing potential challenges early and tailoring solutions to your unique situation, we help streamline what can otherwise be an overwhelming process.

Our ultimate goal is to match you with the best cash-out refinance program that fits your financial needs and future plans while making the experience as smooth as possible. We handle the details so you can focus on your homeownership journey with confidence and peace of mind. Our approach is designed to take the stress out of refinancing for our borrowers and replace it with clarity and support.

How Can Our Cash-Out Refinance Programs Benefit You?

At Michigan Mortgage Solutions, we focus on providing personalized mortgage lending services. Our experienced team works closely with you to understand your financial situation and goals, helping you secure a cash-out loan that best fits your needs.

Our cash-out refinance programs are designed to provide financial assistance, education, and resources to homeowners interested in using their equity to achieve financial goals. Whether you're seeking cash out for and investment, home improvement or any other reason we are here to help. We will find the best program for your needs.

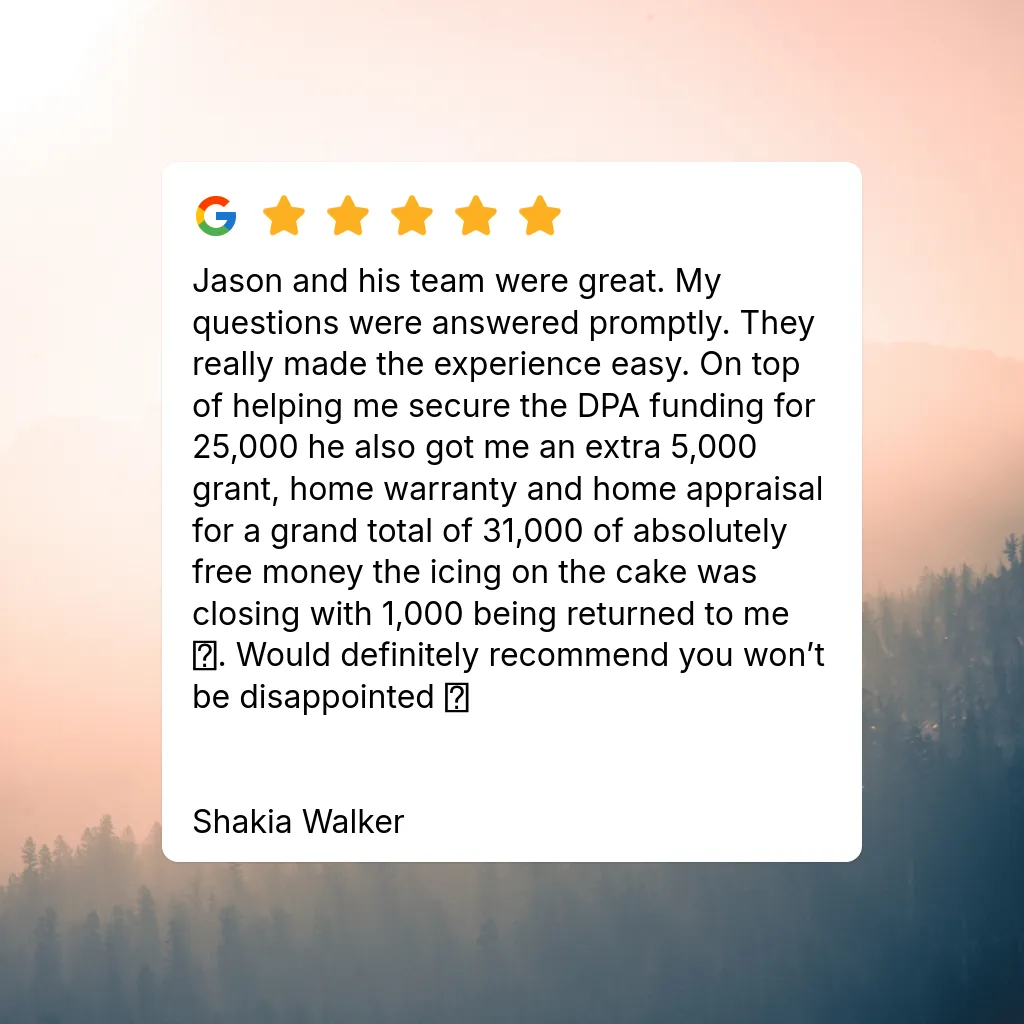

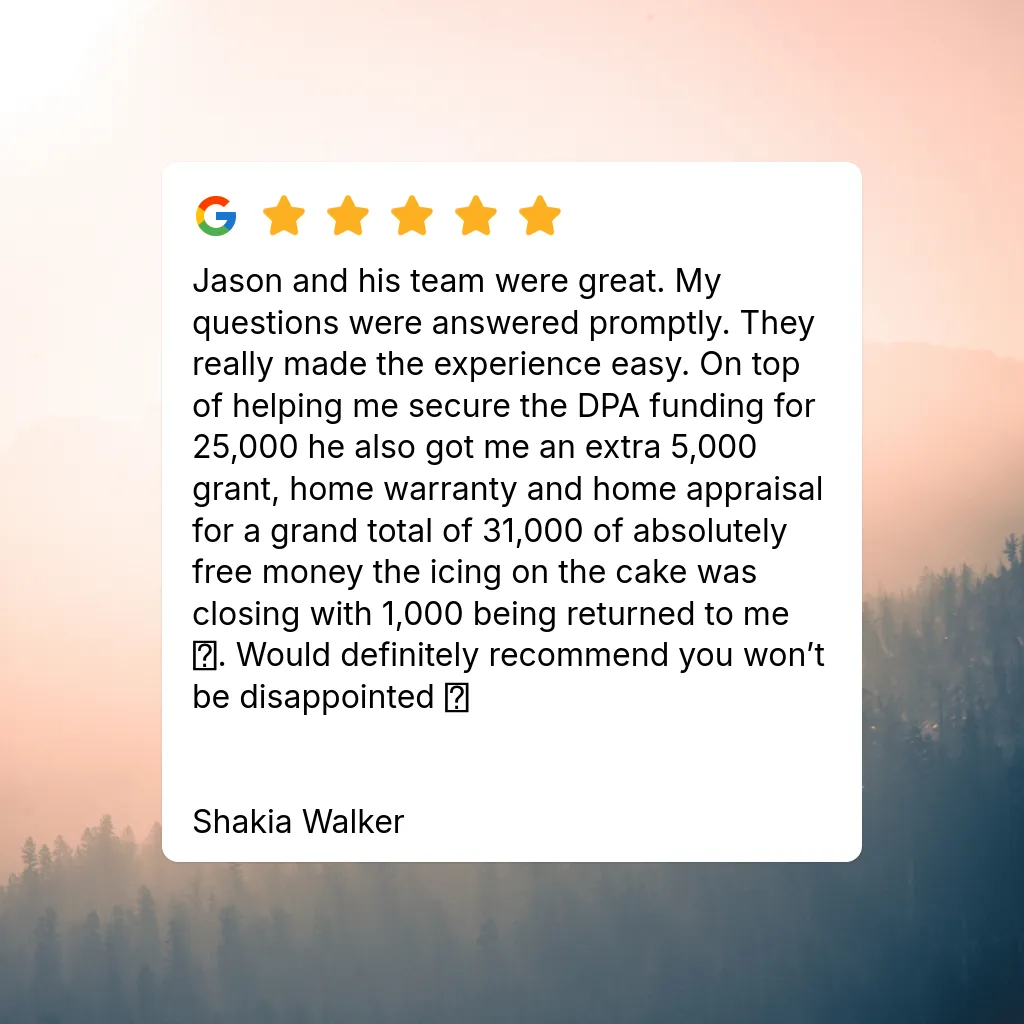

Recent Mortgage Reviews

Recent Mortgage Reviews

Our Process For A

Cash-Out Refinance

Step 1 - Complete Our Quick & Easy Home Loan Quiz

In just 45 seconds, you’ll provide the basic info needed to start your mortgage journey—no hard credit pull or long forms required. It's a fast, simple way to see your options and take the next step toward your homeownership or refinance goals.

Step 2 - Book Your Free Home Loan Consultation

Scheduling your consultation is quick and easy—just pick a date, select a time, and confirm your contact info. In minutes, you'll be all set to chat with a mortgage expert who will guide you through your options and answer all your questions.

Step 3 - Get Pre-Approved With An Accurate Rate Quote

Our pre-approval process is designed to give you clear, accurate details from start to finish. First, we run a soft credit check (so your score stays unaffected) and verify your income. Next, you provide a property address of interest, and we create a personalized financial breakdown using precise numbers based on your loan program and the property details.

Our Process For A

Cash-Out Refinance

Step 1 - Complete Our Quick & Easy Home Loan Quiz

In just 45 seconds, you’ll provide the basic info needed to start your mortgage journey—no hard credit pull or long forms required. It's a fast, simple way to see your options and take the next step toward your homeownership or refinance goals.

Step 2 - Book Your Free Home Loan Consultation

Scheduling your consultation is quick and easy—just pick a date, select a time, and confirm your contact info. In minutes, you'll be all set to chat with a mortgage expert who will guide you through your options and answer all your questions.

Step 3 - Get Pre-Approved With An Accurate Rate Quote

Our pre-approval process is designed to give you clear, accurate details from start to finish. First, we run a soft credit check (so your score stays unaffected) and verify your income. Next, you provide a property address of interest, and we create a personalized financial breakdown using precise numbers based on your loan program and the property details.

Things to Know About

Mortgage Lending

Not All Mortgage Providers Are Created Equal

When it comes to mortgage lending, not all providers offer the same level of service or access to loan options. Banks and direct lenders may only provide their own limited set of mortgage programs, which can restrict your ability to find the best terms for your financial situation. They also mainly work bankers hours which may hinder your ability to speak with your lender after hours or on the weekend.

In contrast, working with a mortgage broker can significantly expand your options. Brokers have access to a wide network of lenders, which allows them to shop for competitive interest rates and loan programs tailored to your unique needs. This flexibility often results in better terms, lower fees, and a more personalized experience compared to traditional lending institutions.

Plus, at Michigan Mortgage Solutions we make ourselves available after hours and on weekends when our clients need us. The majority or purchase deals usually happen after hours or on the weekend so this is key to making the best offer.

The Importance of Avoiding a Hard Credit Pull Too Early in The Pre-Approval Process

A common misconception in mortgage loans is that a hard credit inquiry is required to get pre-approved, but this isn’t always true. Experienced mortgage professionals can use soft credit pull data to estimate your eligibility without impacting your credit score. This approach prevents unnecessary hard inquiries, which can lower your credit score and trigger unwanted outreach from competing lenders who purchase trigger leads.

By waiting to authorize a hard credit pull until you're ready to lock in a rate, you not only protect your credit but also maintain control over your mortgage process without unnecessary distractions or sales pitches from other lenders.

Why Online Reviews Matter When Choosing a Mortgage Lender

Before committing to a lender, it's essential to research online reviews to understand their areas of expertise. Many lenders focus heavily on refinance loans, and their customer service for home purchases—especially for first-time buyers—may not be as seamless.

If most reviews highlight positive experiences with refinancing but have limited mentions of purchase transactions, it could indicate a less-than-ideal fit for someone navigating the complexities of buying their first home. Look for reviews that mention successful purchases, responsiveness, and support throughout the home-buying process. This due diligence helps ensure you choose a lender experienced in your type of loan, leading to a smoother and more satisfying mortgage experience.

Work with Michigan Mortgage Solutions

At Michigan Mortgage Solutions, we’re dedicated to helping you navigate the mortgage process with ease and confidence. Our team combines years of expertise with a client-first approach to find the best mortgage program for your unique financial situation. Whether you're a first-time homebuyer or looking to refinance, our goal is to simplify the lending experience and secure the best terms for you.

We invite you to schedule a free home loan consultation to discuss your options and take the first step toward achieving your homeownership goals. Let us show you how personalized service and expert guidance can make all the difference in your mortgage journey.

Cash-Out Refinance FAQ's

Frequently Asked Questions About The Cash-Out Refinance

Cash-Out Refinance FAQ's

Frequently Asked Questions About The Cash-Out Refinance

Q: What is a cash-out refinance?

A: A cash-out refinance replaces your current mortgage with a new one, allowing you to borrow against your home’s equity and receive the difference in cash.

Q: How can I use the cash from a cash-out refinance?

A: The funds from a cash-out refinance can be used for various purposes, including home improvements, debt consolidation, education expenses, or other major financial goals.

Q: How much equity do I need to qualify for a cash-out refinance?

A: Most lenders require you to maintain at least 20% equity in your home after refinancing, meaning you can typically borrow up to 80% of your home’s value.

Q: Does a cash-out refinance affect my interest rate?

A: A cash-out refinance may result in a slightly higher interest rate compared to a rate-and-term refinance. However, it could still be lower than the rates on other types of loans, such as personal loans or credit cards.

Q: What are the benefits of a cash-out refinance?

A: Benefits include access to large sums of cash, potential tax advantages, and the ability to consolidate higher-interest debts into a single, lower-interest mortgage payment.

Q: Are there closing costs for a cash-out refinance?

A: Yes, cash-out refinance loans typically have closing costs, which can range from 2% to 5% of the loan amount. These can often be rolled into the loan itself.

Q: Can I qualify for a cash-out refinance with bad credit?

A: While a good credit score improves your chances of approval, some lenders offer cash-out refinancing options to borrowers with lower credit scores. Discuss your options with Michigan Mortgage Solutions to find the best program for your situation.

Contact Us

Service Hours

Social Media

Monday - Friday: 9:00 AM - 6:00 PM

Saturday: 9:00 AM - 12:00 PM

Sunday: Closed

More Locations We Serve

All Rights Reserved Corporate NMLS 136972

Contact Us

(248) 963-1894

35 W Huron St #301

Pontiac, MI 48342

Service Hours

Monday - Friday: 9:00 AM - 6:00 PM

Saturday: 9:00 AM - 12:00 PM

Sunday: Closed

Social Media