DSCR Loan vs Conventional: Why Investors Choose DSCR

What Makes a DSCR Loan Better Than Conventional for Real Estate Investors

If you are building a rental portfolio and hitting walls with traditional financing, you are not alone. Conventional loans work great for your first few properties, but they start working against you the moment your personal debt-to-income ratio gets stretched thin.

TL;DR: DSCR loans qualify you based on the property's income potential rather than your personal finances, making them the smarter choice for investors scaling beyond a few rentals. If you want to grow your portfolio without your W-2 income holding you back, DSCR financing removes the biggest barrier standing in your way.

The Problem With Conventional Loans for Investors

Let me be direct with you. Conventional loans were designed for homeowners, not investors. They work fine when you are buying your primary residence or maybe picking up your first rental property. But the moment you start thinking like a portfolio builder, conventional financing becomes a bottleneck.

Here is why.

Conventional lenders calculate your debt-to-income ratio by stacking all your existing mortgage payments against your personal income. Even if your rental properties are cash flowing beautifully, most lenders only credit you with 75% of that rental income. The rest? They ignore it completely.

So what happens when you own three or four rentals and want to add a fifth? Your DTI ratio looks terrible on paper, even though your properties are performing exactly as planned. The bank sees risk. You see opportunity slipping away.

This is the exact frustration I hear from investors every single week. They have the deal. They have the down payment. They have the track record. But conventional guidelines shut the door anyway.

How DSCR Loans Change the Game

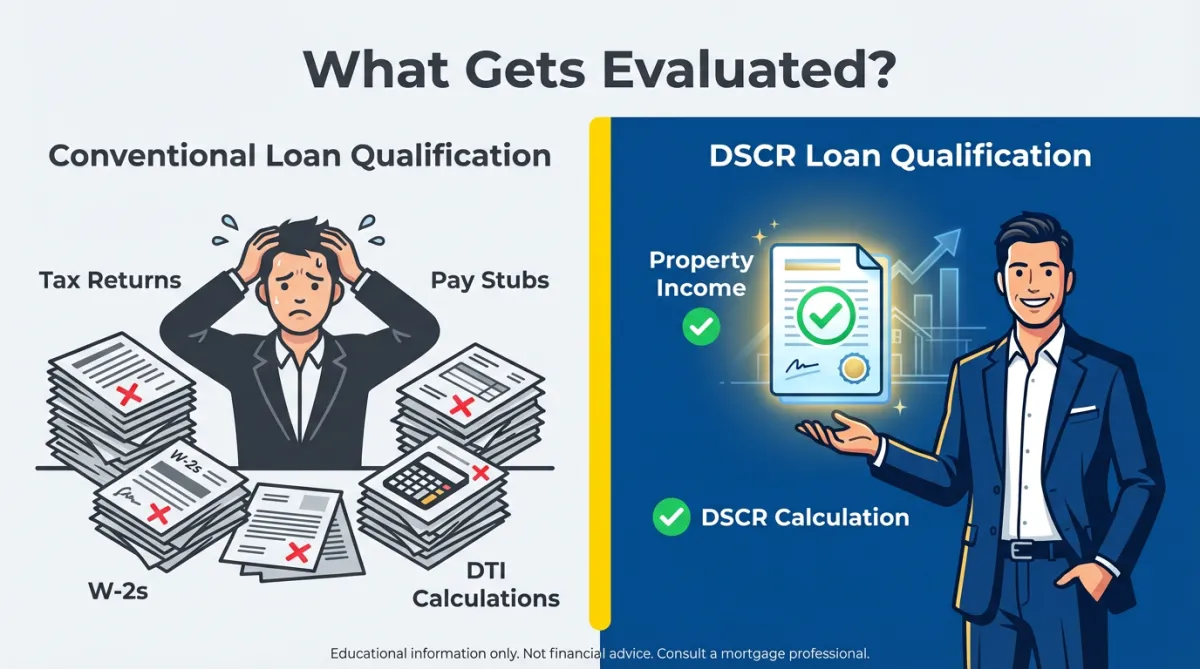

A DSCR loan flips the entire qualification process on its head. Instead of obsessing over your personal income, tax returns, and employment history, the lender focuses on one simple question: Can this property pay for itself?

The debt service coverage ratio measures the relationship between a property's net operating income and its total debt obligation. The formula is straightforward:

DSCR = Net Operating Income / Total Debt Service

If a property generates $2,000 per month in net operating income and the mortgage payment is $1,600, the DSCR is 1.25. That means the property produces 25% more income than it needs to cover the debt. Most lenders want to see a DSCR of 1.0 or higher, with 1.25 being a common benchmark for favorable terms.

The beauty of this approach is that your personal financial situation becomes secondary. You do not need to prove income through pay stubs or tax returns. You do not need to worry about how many other mortgages you already carry. The property stands on its own merit.

Five Reasons DSCR Loans Are Better for Portfolio Builders

1. No Personal Income Verification

This is the single biggest advantage for serious investors. If you are self-employed, write off significant business expenses, or simply have a complicated tax situation, conventional lenders will make your life difficult. DSCR lenders do not care what your tax returns look like because they are not looking at them.

2. Scale Without Limits

Conventional financing caps out quickly. Fannie Mae and Freddie Mac limit most borrowers to 10 financed properties total. DSCR loans have no such restriction. If you find a deal that works, you can finance it. Period.

3. Faster Closings

Because DSCR loans skip the deep dive into your personal finances, the underwriting process moves faster. When you are competing for deals in a tight market, speed matters. I have seen investors lose properties because their conventional lender needed another two weeks to verify income documentation. That does not happen with DSCR.

4. Portfolio Flexibility

DSCR loans are built specifically for investment properties. Whether you are executing a Buy and Hold strategy for long-term cash flow or refinancing out of a short-term loan after completing a BRRRR project, DSCR financing fits the way investors actually operate.

5. Cash Flow Focus

The entire underwriting philosophy aligns with how smart investors think. You are not buying properties based on your salary. You are buying them based on their ability to generate returns. DSCR loans evaluate deals the same way you do.

When Conventional Loans Still Make Sense

I want to be fair here. Conventional loans are not always the wrong choice. If you have strong W-2 income, excellent credit, and you are only buying your first or second rental property, conventional financing will likely offer lower interest rates.

Conventional loans also work for primary residences and second homes, which DSCR loans do not cover. If you are buying a property you plan to live in, conventional is your path.

But the moment you start thinking about building a real portfolio, the math changes. The slightly lower rate on a conventional loan means nothing if you cannot qualify for the fifth, sixth, or seventh property that would actually move the needle on your financial goals.

Matching the Right Loan to Your Strategy

At Michigan Mortgage Solutions, we work with investors every day who are executing specific strategies that require specific financing solutions.

If you are running a Buy and Hold strategy focused on long-term cash flow, our Rental Loan products built around DSCR qualification let you acquire and hold properties without your personal income getting in the way.

If you are executing the BRRRR method, you need a lender who understands that you will be refinancing out of a short-term rehab loan into permanent financing. DSCR loans make that transition seamless because the refinance qualification is based on the property's new rental income, not your tax returns from two years ago.

For New Construction investors building rental properties from the ground up, our New Construction Loan products provide the capital to build, and DSCR financing provides the exit strategy once the property is stabilized and leased.

The point is this: your financing should support your strategy, not limit it.

What You Need to Qualify for a DSCR Loan

DSCR loans are more accessible than most investors realize. Here is what lenders typically look for:

Property DSCR of 1.0 or higher (1.25 is ideal for best terms)

Credit score of 660 or above (some programs go lower)

Down payment of 10-25% for purchases

Property must be an investment property (no primary residences)

Appraisal with rental income analysis

Notice what is missing from that list. No tax returns. No pay stubs. No employer verification. No complicated explanations about why your adjusted gross income does not reflect your actual financial strength.

The Bottom Line

If you are serious about building a rental portfolio, you need financing that grows with you. Conventional loans will take you part of the way, but they will eventually become the ceiling that stops your progress.

DSCR loans remove that ceiling. They let the property speak for itself. They let you scale based on deal quality rather than personal income limitations. And they let you move faster when opportunities appear.

This is exactly why we specialize in investor-focused lending at Michigan Mortgage Solutions. We understand that your goals go beyond buying one or two rentals. You want financial freedom. You want passive income. You want a portfolio that works for you.

The right financing makes that possible.

Ready to see how DSCR loans can accelerate your portfolio growth? Schedule a Free Investor Consultation with our team. We will review your current situation, discuss your investment strategy, and show you exactly what financing options are available for your next deal.

Visit michiganmortgagesolutions.com/investor-consultation or call (248) 963-1894 to get started.